PayPal Pay in 4 is a feature under PayPal Pay Later service designed to enhance the shopping experience by providing financial flexibility.

The PayPal Pay in 4 process is straightforward. When you use PayPal Pay in 4, you split the total cost of your purchase into four payments. You make the first payment at the time of purchase, and then spread the remaining three payments over six weeks. This is interest-free, which means you don’t pay extra if you follow the payment schedule.

PayPal Pay in 4 is a convenient option for managing cash flow while making necessary or desired purchases without waiting.

When and Why was PayPal Pay in 4 introduced?

PayPal entry into the BNPL market gained prominence in September 2020. This was when they officially announced the launch of PayPal Pay in 4 as part of their broader PayPal Pay Later offerings.

The move aimed to provide consumers and merchants with more flexible payment options, given the rising popularity of BNPL services. The Best Buy Now Pay Later apps in the market have already started allowing customers to make purchases immediately and spread the cost over time.

BNPL services offered payment flexibility without incurring interest, provided the user pays back within the agreed timeframe.

The introduction of PayPal Pay in 4 was a strategic response to the growing demand for financial flexibility.

PayPal Pay Later Services: PayPal Pay in 4 & PayPal Monthly

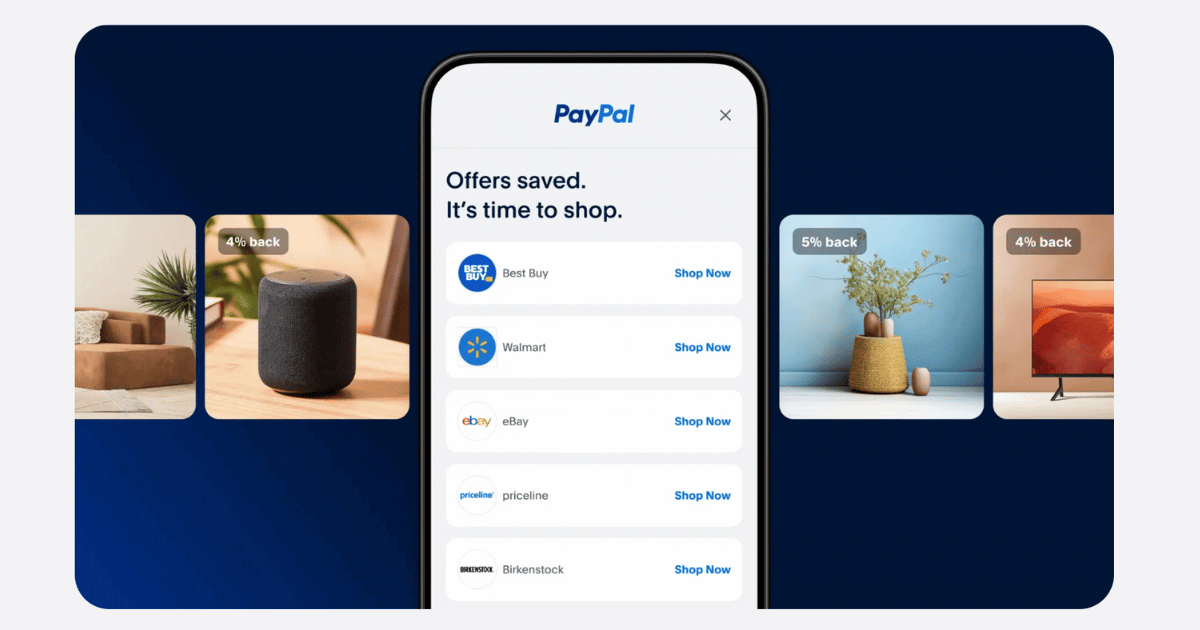

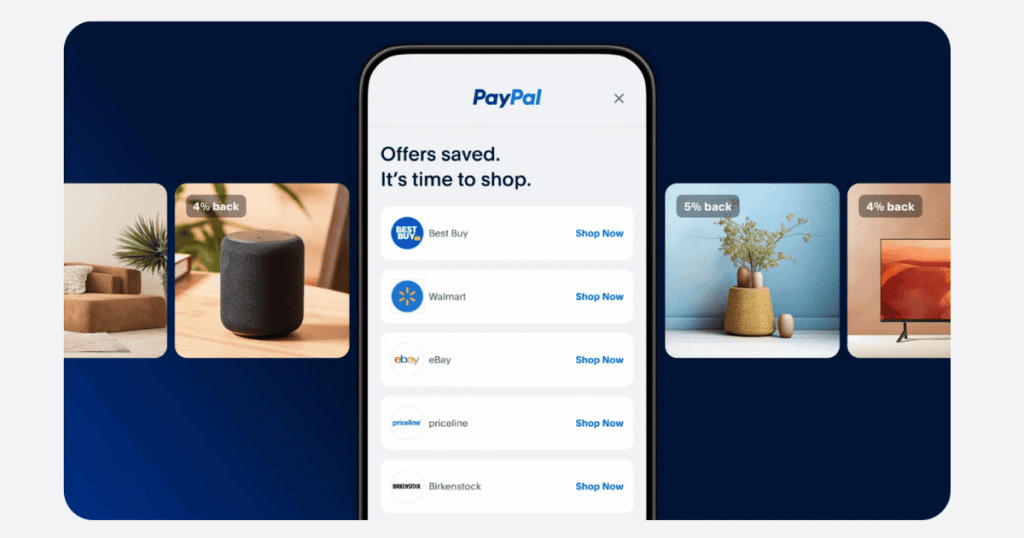

PayPal Pay Later services include PayPal Pay in 4 and PayPal Monthly, whichever payment options suit the consumer’s needs and preferences.

This BNPL service offers flexible payment options for different financial situations. PayPal Pay Later enables customers to make purchases upfront and pay for them gradually over time.

Whether for small or large items, PayPal Pay Later provides a way to manage payments in a manner that fits users’ budgets and timelines.

PayPal Payment Plans Structuring & Commitments

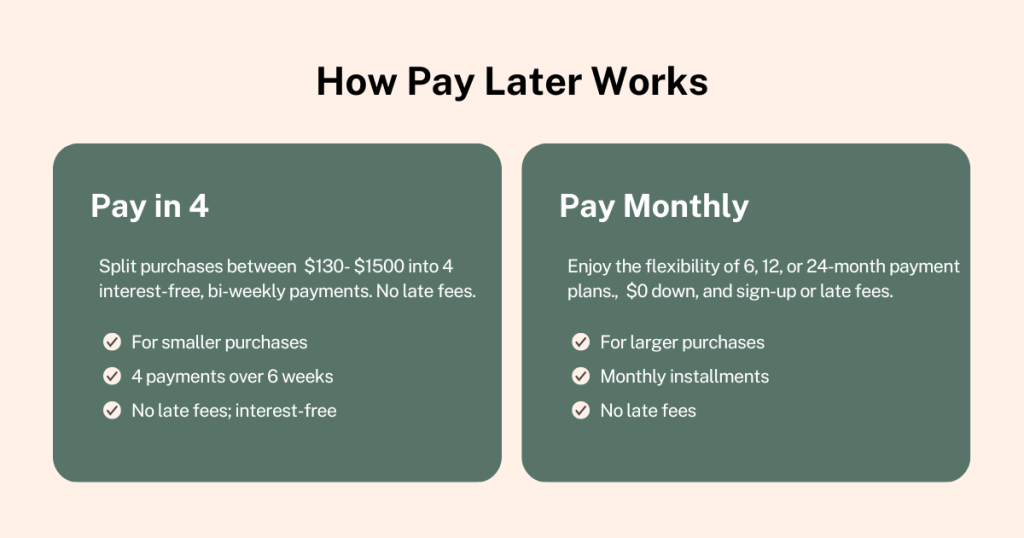

PayPal Pay Later offers tailored payment plans within the range of services. These plans are designed to help users manage their expenses more effectively by providing a structured approach to payment.

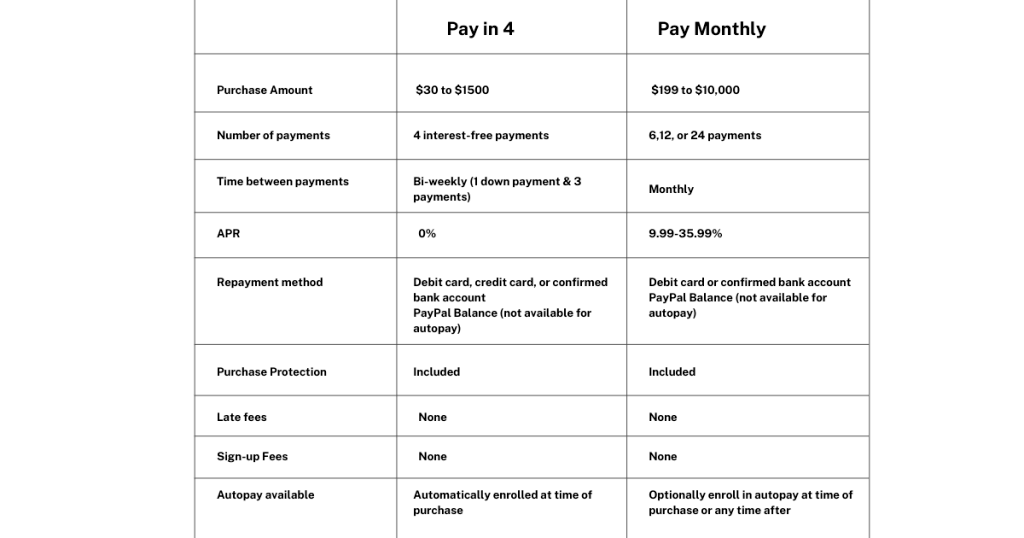

While PayPal Pay in 4 is suitable for smaller, manageable amounts, PayPal also offers other plans for more significant purchases that require longer repayment. PayPal’s flexibility in payment planning(PayPal Pay in 4 & PayPal Monthly) helps users stay in control of their finances.

These features allow users to make purchases without disrupting their financial stability. Let’s take a closer look at these features.

PayPal Split Payment

PayPal Split Payment feature addresses the need for shared financial responsibility. It allows multiple users to contribute to the cost of a single purchase.

PayPal Split Payment simplifies collective purchases, ideal for group gifts, shared subscriptions, or splitting the bill among friends. It encourages collaboration and eases the financial burden on any one individual by dividing the expense evenly.

PayPal Monthly

PayPal Monthly payment plan can be an excellent option for those who need or prefer to extend their payment period beyond a few weeks. These plans are more suited for larger purchases that would strain your budget if paid all at once.

By extending payments over several months, users can manage bigger expenses without compromising their financial health. PayPal Monthly is particularly beneficial for expensive items. This allows users to enjoy their purchase immediately while spreading the cost over a period that suits their financial situation.

How does PayPal Pay in 4 work?

PayPal Pay in 4 is an integral part of its broader BNPL offerings, promoting convenience and financial flexibility for its users. From easy PayPal signup to flexible payment options that accommodate both immediate and deferred payment preferences, PayPal ensures that managing your finances and purchases is as smooth and hassle-free as possible.

PayPal Signup

First things first, to use any of PayPal’s services, including PayPal Pay in 4, you need an account. PayPal Signup is a straightforward process. Visit PayPal’s website or app and provide some basic information (like your name, address, and email). After filling out the information, link a payment method (such as a bank account, credit card, or debit card).

That’s it. You’re set to use Paypal Pay in 4 services.

This account will be your gateway to PayPal Pay in 4 and a multitude of other financial services PayPal offers.

PayPal Buy Now, Pay Later No Down Payment Options

The Buy Now, Pay Later (BNPL) No Down Payment option is most directly associated with PayPal’s Pay in 4 feature. This option is specifically aimed at smaller to medium-sized purchases. It is designed to split the total purchase amount into four payments over six weeks, with no down payment required at the time of purchase.

Here’s how Buy Now, Pay Later No Down Payment typically works:

1. When you check out with PayPal at an online store, you’ll have the option to choose Pay in 4 if your purchase falls within the eligible amount range.

2. After a quick approval process, you can proceed with the purchase without paying anything upfront.

3. The total cost is split into four payments, with the first due at the time of purchase and the remaining three billed every two weeks.

The situation can vary when it comes to the PayPal Monthly payment option, which extends the payment period over several months. These extended plans often cater to larger purchases and may come with different terms compared to the PayPal Pay in 4 services.

Depending on the specific PayPal monthly plan, a down payment may or may not be required. Some of these plans might include interest or fees, unlike the interest-free Pay in 4 option.

Customers interested in using PayPal’s longer-term payment options should carefully read the terms and conditions. They might encounter different requirements, including the potential for a down payment or the accrual of interest over time.

PayPal Buy Now, Pay Later vs. PayPal Pay Later

When comparing best Buy Now, Pay Later (BNPL) options, it’s essential to understand the offerings and how they fit into different financial and shopping scenarios. PayPal offers two notable BNPL services. “PayPal Buy Now, Pay Later” and “PayPal Pay Later,” which cater to a wide array of needs and preferences. Let’s go through these services and what users think about them.

PayPal Buy Now, Pay Later (including Pay in 4):

Flexibility: This option is particularly tailored for smaller purchases that can be paid off quickly. PayPal Pay in 4 is typically in four payments over six weeks. It’s great for consumers looking for short-term payment plans without interest.

Usage: Ideal for everyday shopping, allowing consumers to manage their cash flow better without taking on long-term debt.

Accessibility: Generally available to PayPal users in the United States, United Kingdom, Australia, France, Germany, and other select markets where Pay in 4 or similar services are offered.

PayPal Pay Later (Long-term BNPL plans):

Flexibility: Designed for larger purchases, this option provides longer-term payment plans that can extend over several months. Depending on the terms, interest may or may not be applied.

Usage: Suitable for big-ticket items or services where spreading out payments over a longer period can ease financial burden.

Accessibility: Availability can vary based on your location and the specific PayPal services offered in your region. It’s typically available in most markets where PayPal operates.

Where is PayPal Pay Accepted?

PayPal operates globally, offering a vast range of services across continents. The World Population Review tabulated that the United States has the most PayPal users with 278.10 million or 38.87%. This is followed by Germany, which has 137.70 million users, or 19.25%, and the United Kingdom, with 56.20 million users, or 7.85%.

However, the availability of specific features like PayPal Pay in 4 or long-term BNPL plans can vary. In general, PayPal’s BNPL services are primarily available in countries like the United States, United Kingdom, Australia, and parts of Europe.

The list of supported countries and the level of service available can change. For the most accurate and up-to-date information, it’s best to check directly with PayPal or consult their official website.

PayPal Reviews

User reviews of PayPal’s BNPL services tend to highlight a few key points:

Convenience: Users appreciate the flexibility and convenience of spreading out payments without interest. PayPal pay later features, especially for unplanned or emergency purchases, came in handy for many users.

Trust: As a well-established payment platform, PayPal Buy Now Pay Later services are seen as trustworthy and reliable.

Accessibility: The ease of use and integration with online merchants where PayPal pay later is accepted makes it a go-to option for many shoppers.

Customer Service: While many users have positive experiences, some reviews point to challenges in resolving issues or disputes when things go wrong, which is a common theme across many financial services.

PayPal Pay Later and Best Buy Now Pay Later apps offer versatile options to fit various shopping and financial needs. Whether you’re making small, manageable purchases or need to finance a significant expense over time, PayPal Pay in 4 and Paypal Pay Later features provide solutions designed to ease financial pressure.

While BNPL plans can be a convenient way to make purchases, it’s essential to remember that they are a form of financial service. Before enrolling in a BNPL plan, it’s critical to evaluate your personal financial situation and review the terms of service thoroughly. This will help you make an informed decision and avoid any potential financial pitfalls.