Best Buy Now Pay Later apps offer a flexible way to spread out payments for purchases over time, making shopping more manageable financially.

Buy Now Pay Later (BNPL) apps have become a compelling alternative to traditional credit for consumers looking to spread the cost of purchases over time. The shift in how people are choosing to finance their spending habits with the use of BNPL apps is transitioning the consumer patterns of modern e-commerce in the US.

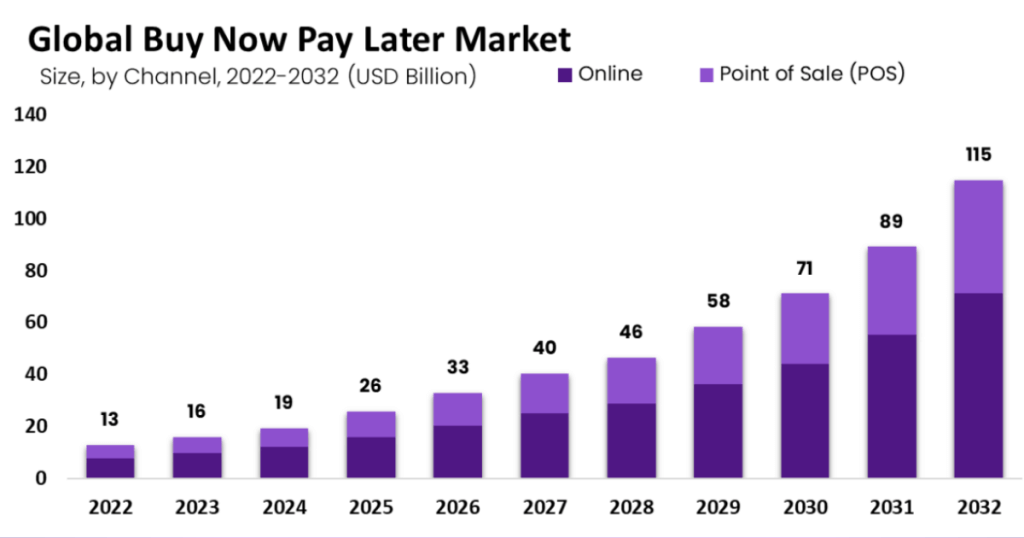

While it’s true that the yearly growth rate has settled down to a more sustainable 14.8%, the market is still on an upward trajectory. The demand for the best Buy Now, Pay Later (BNPL) apps is also predicted to rise steadily through 2027.

This means that BNPL apps aren’t just surviving. The demand for these Best Buy Now Pay Later apps is evolving and adapting to a crowded market where consumers are more discerning, and competition is fierce.

Top 5 Performing Best Buy Now Pay Later Apps

The leading names in the sector of Best Buy Now Pay Later Apps are a mix of established players. Among these Best Buy Now Pay Later apps, the top five are:

Let’s see what do the above apps have in common, making them stand out among the Best Buy Now Pay Later apps.

1. Klarna

History: Founded in 2005 in Sweden, Klarna initially focused on online checkout solutions. It entered the US market in 2015 and has become a major player among the best Buy Now, Pay Later apps.

Parent Company: Klarna Bank AB.

Payment Options: Pay in 4 interest-free installments, “Pay Later” with variable interest rates and longer terms, and monthly financing options with fixed interest rates.

Stores Accepted: Over 400,000 globally, including major retailers like Macy’s, IKEA, and Sephora.

2. Affirm

History: Launched in 2012 in the US, Affirm aimed to provide a transparent and accessible alternative to traditional credit cards.

Parent Company: Affirm Holdings, Inc. (publicly traded company).

Payment Options: Interest-free installments over 3, 6, or 12 months, and longer terms (up to 60 months) with fixed interest rates for larger purchases.

Stores Accepted: Over 170,000, including major retailers like Walmart, Target, and Peloton. They also offer a virtual card for online shopping.

3. Afterpay

History: Founded in 2014 in Australia, Afterpay quickly gained popularity for its focus on fashion and beauty purchases. It entered the US market in 2018.

Parent Company: Square, Inc. (acquired Afterpay in 2022 and is now part of Block, Inc.).

Payment Options: Pay in Four interest-free installments every two weeks.

Stores Accepted: Over 100,000 globally, including major retailers like Ulta Beauty, Urban Outfitters, and ASOS.

4. Sezzle

History: Founded in 2016 in the US, Sezzle aimed to offer a more flexible BNPL option compared to competitors.

Parent Company: Sezzle Inc. (publicly traded company).

Payment Options: You can pay in Four interest-free installments, with the option to reschedule payments for a fee.

Stores Accepted: Over 40,000 globally, including a focus on smaller businesses and independent retailers.

5. PayPal Pay in 4

History: Launched in 2020, PayPal Pay in 4 leverages the existing popularity of PayPal to offer a convenient BNPL option within their platform.

Parent Company: PayPal Holdings, Inc. (publicly traded company).

Payment Options: Pay in Four interest-free installments.

Stores Accepted: Millions of online retailers that accept PayPal.

These apps have found their place and are doubling down on beating other Best Buy Now Pay Later apps. Each of these apps is carving out its territory. They are setting the stage for a battle of benefits where the best BNPL apps aren’t just about spreading costs but enhancing the shopping experience.

Why No Credit Check Buy Now Pay Later Options are Game-Changers

When it comes to financial flexibility, no credit check buy now pay later apps are a game-changer. They empower people to make purchases without the immediate burden of full payment and, most importantly, without the anxiety of a credit check that could affect their credit score.

The absence of no credit check buy now pay later credit check with providers like Klarna and Afterpay allows for a stress-free shopping experience while ensuring that users stay within their spending limits.

Understanding Buy Now Pay Later No Down Payment Benefits

The appeal of buy now pay later no down payment options is unmistakable. Imagine walking into a store, picking up a high-ticket item like a new laptop, and walking out without paying a penny upfront. That’s precisely what you get with apps like Sezzle and Affirm.

It’s a zero-risk entry into your purchase, giving you the breathing space to manage your finances before the first installment hits. This can be particularly beneficial during the holiday shopping season or when unexpected expenses pop up.

Why are Best Buy Now Pay Later Apps becoming Good options for Shoppers?

What sets these apps apart isn’t just their market segments but their approach to the financial side of things. Typically, BNPL apps let consumers split purchases into split installments without interest. This model is especially attractive to younger consumers like Gen Z, who are increasingly using BNPL apps over traditional credit cards. However, there’s a catch. Late fees can bite if payments are missed, and these can add up quickly across different platforms.

So, whether you’re going for the installment payment apps or split payments, make the payments on time. When you’re considering using the Best Buy Now Pay Later apps that are available in the markets, it is best to use them cautiously.

Another critical aspect of BNPL apps’s success is its user-friendliness and accessibility.

In terms of regulation, the best Buy Now Pay Later apps in the US are eyeing increased oversight. This is hardly surprising given the sector’s rapid growth and the potential risks associated with consumer debt. It’s a reminder that as much as BNPL apps are a part of the e-commerce landscape, they’re also financial products subject to scrutiny and potential regulation.

Credit Cards vs. BNPL Apps: Choosing What’s Best for You

The debate between using credit cards and BNPL apps weighs on personal financial habits and needs. Credit cards offer rewards, protection, and the opportunity to build credit history features that BNPL apps typically do not provide. But credit cards also come with higher interest rates. If you miss the payment due date, it leads to a cycle of debt if not managed carefully.

Best Buy Now Pay Later apps, in contrast, offer zero-interest options and a straightforward repayment plan. The BNPL app’s lack of rewards and the potential for negative impacts on spending habits are drawbacks. The best choice depends on individual financial discipline, the need for credit building, and the specific terms offered by the BNPL apps or credit cards.

Embracing Financial Empowerment with BNPL Apps

As we wrap up our exploration of the best Buy Now Pay Later apps, it’s clear that the BNPL app’s innovative financial model offers a compelling alternative to traditional credit solutions. With features like no credit check Buy Now Pay Later options, and buy now pay later no down payment plans, BNPL apps are not only making shopping more accessible but are also reshaping consumer spending habits.

The rise of BNPL companies and the variety of split payment apps and installment payment apps available today highlight a significant shift towards more flexible, user-friendly financial products. Whether it’s for everyday purchases or larger investments, BNPL apps provide a way to manage cash flow more effectively. And that too without the hefty interest rates associated with credit cards.

It’s crucial to use BNPL apps responsibly. Understanding the terms, staying on top of payments, and choosing apps that align with your spending habits and financial goals is key to making the most out of these services.

By choosing the best Buy Now Pay Later apps for your needs, you’re not just making a smart financial choice but embracing a more empowered approach to managing your finances.

Frequently Asked Questions

What is the Klarna app?

Klarna app is a BNPL app that lets you shop at your favorite stores and split your purchases into manageable payments. It’s known for its flexibility, user-friendly interface, and wide acceptance among online and physical retailers.

Can I use BNPL apps without a credit check?

Yes, many BNPL apps, including options for no credit check buy now pay later plans, offer the convenience of splitting your purchase into installments without a hard credit inquiry. However, terms vary, so it’s essential to review each provider’s policy.

How does the Affirm app work?

Affirm offers a transparent BNPL service, allowing users to split their purchases into monthly payments. With Affirm, you’ll see the exact amount you’ll pay each month, with no hidden fees and the option for no down payment in many cases.

Are there any BNPL apps that don’t require a down payment?

Yes, some buy now pay later no down payment options allow you to make your purchase and start paying at a later date, with subsequent installments spread over time.

Is Sezzle a good BNPL App?

Yes, Sezzle reviews often highlight its ease of use and the financial flexibility it offers. Sezzle also allows users to pay in four interest-free installments. However, like any service, it’s wise to consider both positive and negative reviews to get a balanced view.

Can I use Afterpay for Best Buy purchases?

Yes, Best Buy Afterpay is an option for spreading the cost of your electronics and appliances over time with interest-free installments, making big-ticket items more budget-friendly.

What should I look for in BNPL apps?

When searching for the best buy now pay later apps, consider factors like interest rates, fees, repayment terms, and retailer partnerships to find the option that best suits your shopping habits and financial situation.

How do BNPL companies differ from traditional credit?

BNPL companies offer a modern twist on credit, providing short-term installment plans with minimal to no interest. Unlike traditional credit cards, BNPL apps come with fixed repayment schedules and clearer terms.

What are split payment apps?

Split payment apps allow you to divide the cost of a purchase into several payments. This option makes it easier to manage your budget without paying the full amount upfront.

How do installment payment apps differ from other BNPL apps?

While all BNPL apps offer a form of installment payment, some installment payment apps specialize in longer-term plans or specific types of purchases, offering more flexibility in how and when you pay.