Gone are the days when cash and checks ruled the economy. Today, the convenience of a simple swipe, tap, or click through BNPL platforms opens up a world of possibilities but also brings its own set of challenges.

There are many options for spending money and building credit. Credit cards offer rewards and the chance to improve your credit score, while buy now, pay later apps (BNPL platforms) offer flexibility and instant gratification. These choices are tempting, but it’s important to choose wisely.

But with great power comes great responsibility. The decisions we make about which financial tools to use and how to use them can significantly shape our economic future. So, as we peel back the layers of credit cards and BNPL platforms, let’s equip ourselves with knowledge, weigh our options, and make informed choices that align with our financial goals and lifestyle.

Whether you’re a seasoned spender, a credit-building enthusiast, or someone exploring the digital ease of BNPL platforms, understanding the fine details of these financial tools is the first step toward mastering your financial domain.

So, grab a chair while we uncover the secrets between which is better- Credit cards or Buy Now Pay Later apps for a healthier financial life.

Understanding How Credit Cards Function

Once upon a time, credit cards were the new kids on the financial block. Today, they’re essential in our wallets. Let me simplify how these little pieces of plastic work and what they mean to you.

The Basics

Credit Limit: Imagine a bucket of borrowed money – that’s your credit limit. It’s the max you can spend, but remember, it’s not free cash. The borrowed money is a loan on standby.

Interest Rates: If you dip into this bucket and don’t refill it (pay it back) every month, the company will charge interest. It’s like renting money – the longer you keep it, the more rent you pay.

Minimum Payments: To keep the account in good standing, you must pay a minimum amount each month. Stick to this minimum, and you’ll slowly crawl out of debt. If you miss any of these payments, the credit score calculator might affect your creditworthiness.

The Good Stuff of Credit Cards

Rewards and Perks: Users can earn points for flights, cashback on essentials, and more. Smart use equals smart savings.

Credit Building: if you use your card wisely, the credit score calculator will build a credit score that makes lenders smile.

Consumer Protections: If you have fraudulent charges, you may not need to pay for them. And if you have a broken purchase, your card may cover it.

The Downside of Credit Cards

High-Interest Debt: It’s important to keep in mind that overspending can have a compounding effect. It starts small, but with time, it can grow bigger and bigger, much like a snowball that rolls slowly at first, then suddenly becomes huge. Therefore, it’s wise to be mindful of your expenses and keep them in check to avoid any financial setbacks.

Fees: It is wise to keep track of the fees associated with credit cards. Fees, such as annual fees and late fees, can easily catch you off guard if you are not aware of them. Tracking these fees can help you manage your credit card usage and your credit score calculator.

Smart Credit Card Practices for a Healthier Financial Life

Stay Within Budget: Use credit cards as a convenience, not a crutch. Spend what you can afford to pay back.

Pay More Than the Minimum: Chip away at debts faster and save on interest by paying more than the minimum due.

Keep an Eye on Perks: Use rewards to your advantage, but don’t let the chase for points lead you to overspend.

Credit cards can be your financial friends if you treat them right. They’re packed with potential benefits if you use them wisely and avoid the pitfalls of debt and fees.

The Rise of BNPL Platforms

The term ‘Buy Now, Pay Later’ might sound like a modern phenomenon, but its roots are in the olden days when layaway plans let shoppers reserve items and pay over time. Fast-forward to the digital age, and BNPL platforms have taken this concept to new heights. They grew at a pace that’s started turning heads in the finance world.

How BNPL Simplified Installments

Installment Payments: Like splitting your dinner bill, Buy Now Pay Later apps let you divide your purchase into smaller, more digestible payments.

Interest-Free Periods: Most BNPL platforms’ plans won’t charge you a dime in interest if you pay on time, making it easier to splurge on that big-ticket item.

Why People Are in Love with BNPL Platforms

Easy to Access: Sign up in a snap, no lengthy credit score calculator checks are needed, and you’re good to go.

Friendly on the Budget: It’s like putting your spending on a diet – you spread out the payments using the Buy Now Pay Later apps so they don’t bulk up your monthly bills.

Retailer’s Buddy: More and more shops are jumping on the BNPL platforms, giving you the green light to use it at checkout.

The Flip Side of BNPL Platforms

Credit History Non-Builder: Unlike credit cards, BNPL doesn’t flex your credit score muscles. It’s neutral in the credit-building gym.

Late Fees Lurk: Miss a payment, and you could get hit with a fee, much like stumbling on a hidden step.

Overspending Temptation: With BNPL platforms, buying feels like a breeze, which can lead to a shopping spree hangover.

BNPL platforms are reshaping how we think about purchases. These Buy Now Pay Later apps offer an alternative that aligns with the digital, instant-gratification era. It’s a financial tool tailored for the now – convenient and user-friendly.

But just like any shiny new gadget, it’s best used with a bit of caution. Enjoy the perks of split payments, but keep an eye on the calendar and your wallet to avoid any surprises.

Demographic Shifts and Preferences: BNPL Platforms vs Credit Cards

The finance world is always cooking up something new, and BNPL, shorthand for ‘Buy Now, Pay Later,’ is the latest dish on the menu. Let’s peek into how different folks are taking to this new trend.

Who’s Who in the BNPL vs. Credit Card Game

The Young Guns (Gen Z & Millennials): These digital natives are swiping right on BNPL platforms. The flexibility and no-interest hook are what’s got them.

The Experienced Crowd (Gen X & Baby Boomers): They’re sticking with credit cards. They’ve built their scores, love their rewards, and are playing the long game.

By the Numbers

In terms of market size, BNPL platforms lending in the US is expected to reach over $100 billion by 2024, a steep climb from $3 billion in 2019. This expansion reflects the growing acceptance and usage of BNPL platforms among consumers.

Looking at the demographics, Gen Zers (aged 18-25) and Millennials (aged 26-41) lead the charge in the US Buy Now Pay Later apps market, with approximately 58% and 54%, respectively, having used BNPL platforms. This indicates a higher propensity for younger generations to opt for BNPL platforms as a preferred method of payment.

Generation X (42-57 years old) and Baby Boomers (58-76 years old) use BNPL platforms less than younger generations. However, they still show significant engagement, with 44% and 22% usage, respectively.

Interestingly, BNPL platforms are most popular among consumers making $20k—$50k annually. This points to their appeal to those in the lower to middle-income bracket as a manageable financing option.

Despite the convenience and benefits of BNPL platforms, there is also a downside. More than a quarter of Buy Now Pay Later apps users have experienced a late or missed payment. A significant percentage of users regret using BNPL platforms because they spent more than they could afford.

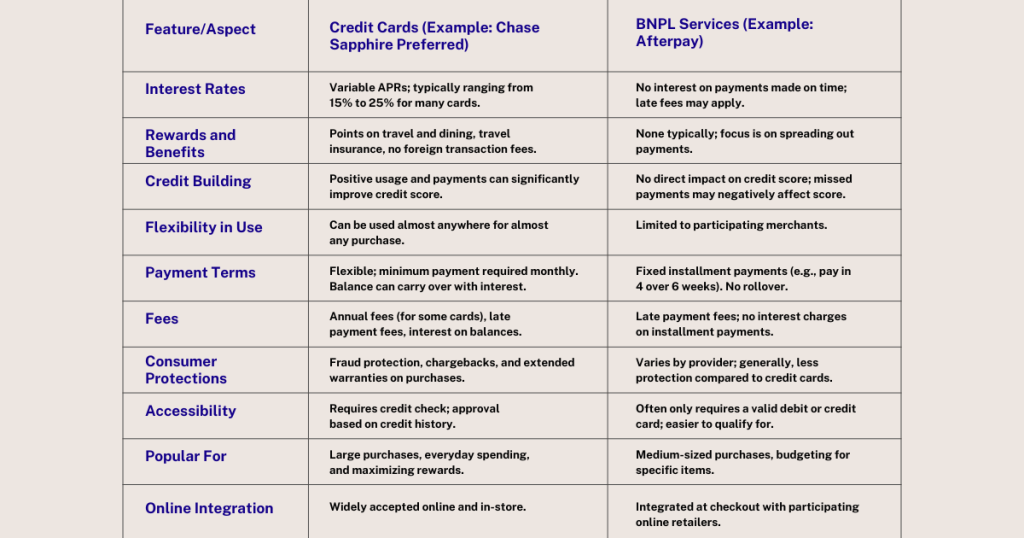

BNPL Platforms vs Credit Cards: Comparing Features Head-to-Head

Now, let’s line them up – BNPL platforms vs credit cards. Let’s see how they manage in the features showdown.

The Contenders

BNPL Heavy-Hitters: Afterpay and Klarna – they’re the ones making waves with their pay-in-four plans.

Credit Card Champs: Chase and American Express – with their fancy points and travel perks, they’re not giving up the throne easily.

Feature Face-Off

Payment Plans: BNPL Platforms gives you a plan. Credit cards give you a limit.

Interest Rates: BNPL Platforms says ‘no interest’. Credit cards say, ‘It depends.’

Rewards: Credit cards come out swinging with points and miles. BNPL Platforms are just getting in the ring.

Credit Building: Credit cards pack a punch near the credit score calculator and help you build a score. BNPL Platforms are more about the now and not the later.

This face-off is about features that fit your lifestyle. Young shoppers might like the BNPL platform’s easy approach, while seasoned spenders might go for credit cards for long-term perks. It’s all about choice and what suits one’s financial journey.

Making the Right Choice for Your Financial Health

Picking between Buy Now Pay Later apps and credit cards isn’t just about “eeny, meeny, miny, moe.” It’s a personal finance decision that can affect your wallet and peace of mind.

Here’s what one should weigh before they decide:

BNPL platforms vs Credit cards: Factors to Consider

Financial Goals: Are you trying to build credit? Maybe a credit card is your alley. Just need to split a big purchase? Buy Now Pay Later apps might do the trick.

Spending Habits: If you’re disciplined with money, credit cards can be your friend. If you tend to overspend, BNPL platform’s fixed payments could keep you in line.

Credit Needs: Looking to finance a car or a home down the road? A credit card can help build your credit history, which BNPL platforms typically don’t.

Smart Moves for Using BNPL and Credit Cards

Have a Plan: Know how you’ll pay back what you owe, whether it’s through Buy Now Pay Later apps or credit card payments.

Read the Fine Print: Understand the fees, interest rates, and terms. No surprises, no sweat.

Keep Track: Monitor your purchases and payments. Apps and spreadsheets can be lifesavers.

Conclusion

Remember the start of this blog? We’ve journeyed through the ins and outs of BNPL platforms and credit cards. We’ve seen the good, the iffy, and the handy.

Think about how you spend and what you want for your financial future. Do you like collecting points like they’re going out of style, or are you just after a simple way to manage big-ticket buys?

Finance is no longer just “one size fits all.” It’s as varied as our lives. So, take a beat, ponder your habits, and choose the tool that fits you like a glove. And keep an eye out – because as sure as the sun rises, the finance world will keep evolving. And who knows? Maybe there’s something even better on the horizon.