Affirm app is a financial platform that’s reshaping the way we think about purchasing and credit.

Affirm app stands out in the crowded fintech Buy Now, Pay Later apps for a few key reasons. It offers consumers transparent, flexible payment options without hidden fees or compounding interest. Affirm stands out among Buy Now Pay Later apps for its transparency in a sector often criticized for being indistinct.

At its heart, Affirm is a pioneer of the “Buy Now Pay Later Apps” (BNPL) movement. It was founded by Max Levchin, Nathan Gettings, Jeffrey Kaditz, and Alex Rampell in 2012. Affirm app, like other renowned pay over time apps, allows shoppers to make purchases and split the cost into smaller, more manageable payments over time.

Affirm App: How It Works?

When you’re about to make a purchase, be it through online shopping apps or in select retail stores, and you choose to pay with Affirm app. With the easy Affirm login, the process kicks off with a quick eligibility check. This doesn’t impact your credit score, which is great.

Affirm app, like the rest of pay over time apps and BNPL platforms, offers you a few payment plan options. You can split payments or you can even opt for pay in 4 installments, typically ranging from three to 36 months, depending on the purchase size.

The interest rates can vary, but they’re always shown upfront, making it easy to understand the total cost of your purchase over time.

Affirm Payment: Split Payments and Pay in Four Installments

With Affirm payment features, you get a somewhat flexible approach to managing your payments. While the platform is known for its “buy now, pay later” setup, the exact terms, including the option to split payments into four installments, can vary.

Affirm Payments typically offers a range of payment plans, from a month to 36 months, based on the retailer, the amount, and your credit profile. However, it’s important to note that specific four-installment plans might be available with some merchants or for certain purchases, reflecting Affirm’s aim to offer customizable payment solutions to fit different needs.

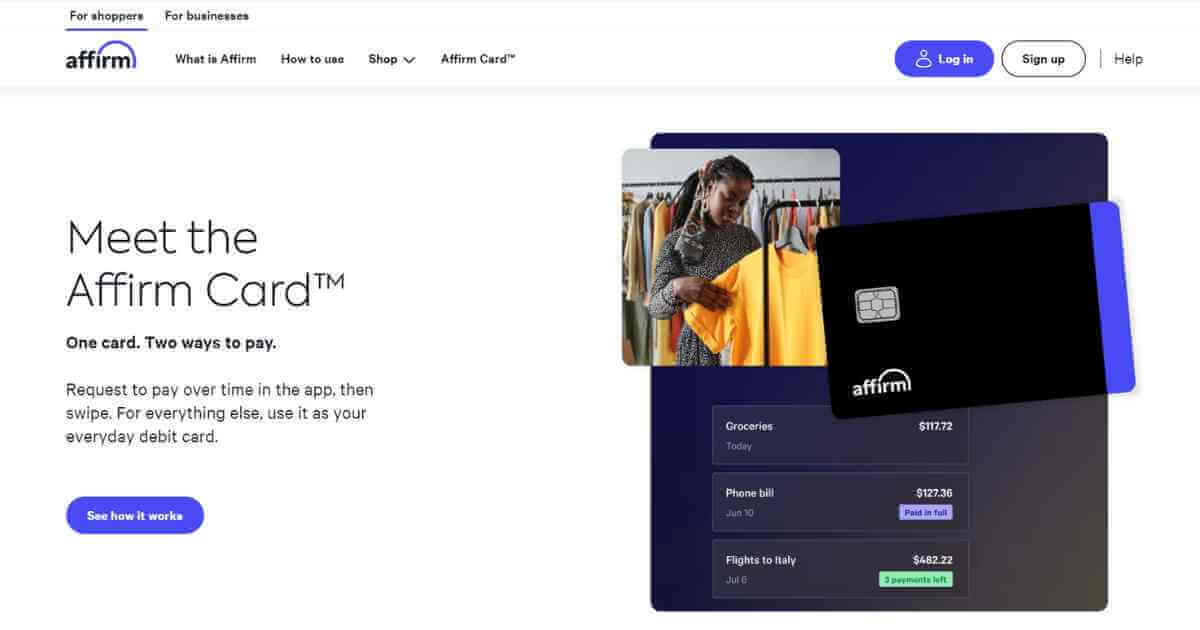

Affirm Virtual Card

The Affirm virtual card is a digital Affirm payment tool that allows you to use your Affirm credit to make purchases at almost any merchant, not just those directly partnered with Affirm.

Here’s how it generally works:

Issuance: Once you’re approved for a loan from Affirm to make a purchase, you can opt to use a virtual card for the transaction. This card is generated within the Affirm app or website.

Functionality: The Affirm virtual card operates similarly to a traditional credit card but is used for a single transaction. It comes with a unique card number, expiration date, and CVV.

Flexibility: You can use the Affirm virtual card at a wide range of retailers, even those that don’t have a direct partnership with Affirm. This massively expands where you can shop with Affirm’s financing options.

Security: Since the card is virtual and designed for a one-time use, it offers a secure way to make purchases without exposing your real credit card details.

Affirm virtual card effectively bridges the gap between Affirm’s partnered merchants and the broader retail world. This tool offers a seamless and secure method to finance your purchases virtually anywhere.

Highest Credit Limit Available on Affirm BNPL Platform

Affirm offers customized credit limit offers based on individual financial profiles, which can make it difficult to find the highest available credit limit. Generally, limits can go up to $17,500 for well-qualified customers.

This high ceiling is designed to accommodate larger purchases, but it’s crucial to remember that such limits are extended to borrowers with solid credit histories and proven repayment capabilities.

Basis for Credit Limit Determination On Affirm App

Affirm app uses a comprehensive approach to determine your credit limit, considering factors like your credit score, payment history (particularly with Affirm), income, employment status, and the specifics of the purchase you intend to make.

This personalized assessment ensures that the credit limit offered is in line with your financial health and the perceived risk.

Ideal Credit Score for Affirm BNPL Platform

Affirm doesn’t explicitly state an ideal credit score for approval, as it considers various factors beyond just your credit score. However, having a good credit score (usually scores above 640) can improve your chances of getting approved with more favorable terms.

Affirm app aims to be accessible to a wide range of borrowers. This includes those with less-than-perfect credit, focusing on current financial health and the capacity to repay.

Fees on Affirm App: Hidden, Late, or Service

One of the appealing aspects of Affirm is its commitment to no extra charges, unlike the other pay over time apps.

No Hidden Fees: You won’t find any unexpected charges tacked onto your bill.

No Late Fees: Affirm app does not charge late fees, even if you miss a payment. However, missing payments can affect your ability to secure future loans with Affirm.

No Service Fees: Affirm prides itself on transparency, which extends to not imposing service fees on its loans.

By focusing on transparent pricing and terms, Affirm positions itself as a user-friendly option for financing purchases. This approach helps you plan and manage your finances without worrying about unforeseen costs that could derail your budget.

Interest Rates on Purchases and Loans

Interest rates on Affirm loans can vary widely based on creditworthiness and other factors. These usually range from 0% APR on promotional offers with certain retailers to rates that can go up to 30% APR. The specific interest rate you’re offered will be transparently shown to you before you commit to the loan to make an informed decision.

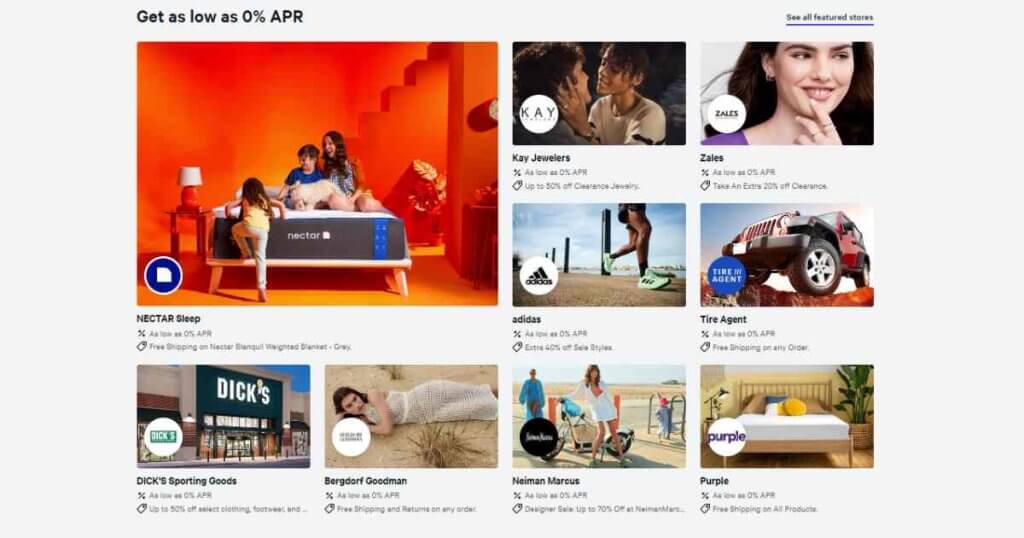

Merchants Available on Affirm App

Affirm partners with a wide collection of merchants across various sectors. Affirm payment options are popular among online shopping apps looking for manageable payment solutions. The list of merchants that accept Affirm spans from home furnishings and electronics to travel and fashion.

Affirm’s partnerships include well-known brands and retailers across several categories:

Electronics: Think of big names like Best Buy, where you can finance the latest gadgets.

Home Furnishings: Companies like Wayfair and West Elm allow you to decorate your space on a payment plan.

Travel: Websites like Expedia offer the chance to book now and pay later for flights, hotels, and vacation packages.

Fashion and Beauty: Retailers such as Adidas and Sephora make it easier to stay stylish with payment plans.

Other famous names include:

Delta Vacations

Expedia Hotels

CheapOair

Peloton

Walmart.com

Pottery Barn

Williams Sonoma

This diversity in partnerships means that almost any type of purchase. From upgrading your laptop to booking a dream vacation, you can finance many things through Affirm app.

The Credit Acceptance by Retailers on Affirm App

The amount of credit Affirm extends for purchases varies significantly. The terms are often tailored to the specific transaction, the merchant’s terms, and the customer’s credit profile.

Here’s a breakdown of how this works:

Varied by Merchant: Some merchants may have specific deals with Affirm app. They offer special financing terms, such as 0% APR or a fixed payment plan over a certain number of months.

Customized to Your Purchase and Profile: The credit Affirm offers is not a one-size-fits-all. It depends on your credit score, your payment history, and the purchase amount. For larger purchases, Affirm may offer higher credit limits, assuming you meet their creditworthiness criteria.

Transparency at Checkout: When you select Affirm as a payment method at checkout, you’ll be presented with various payment options, showing exactly how much credit you can use for that purchase. This process includes a soft credit check that doesn’t impact your credit score, enabling Affirm to offer a personalized credit limit for the transaction.

Affirm Review compared to other Pay-Over-Time Apps

Affirm’s business model is quite intriguing, and it can transform our perception of credit and purchasing is impressive.

The company’s commitment to transparency and consumer-friendly terms is paving the way for a future where financial products are more accessible and understandable. However, it is important to acknowledge that there are some challenges and uncertainties on the horizon.

Affirm is more than just a financial technology company. This BNPL platform is challenging traditional notions of credit and consumer finance. Whether you’re a consumer looking for flexible payment options from pay over time apps or a retailer aiming to boost sales, Affirm’s model offers compelling benefits.

It’s crucial to use Pay-Over-Time-Apps wisely and comprehend the terms and their effect on your financial well-being to make the most of these BNPL Platforms.