We all know that nature and financial emergencies do not operate on a schedule. Thanks to the digital transformations in present scenarios, we can at least escape economic setbacks. Today, I’ll introduce you to one such resource where you can pool some money in emergencies: Green Dollar Loans, a payday loan platform that can provide peace of mind.

Yet, just because I believe, doesn’t mean you have to believe me straight away, and it should not be the first or only avenue explored. Considering alternatives that offer lower interest rates and more favorable terms should be part of anyone’s financial strategy.

Financial literacy is critical. Understanding different financial products and how they work can empower you to make choices that best suit your financial situation.

This guide will discuss what makes Green Dollar Loans a legitimate platform.

Green Dollar Loans: A Payday Loan Provider

Green Dollar Loans offers payday loans through a user-friendly online platform. This service is particularly beneficial for individuals experiencing a financial crunch.

The main features include:

- Rapid Approval and Funding: They are known for their swift approval process, with funds typically deposited by the next business day.

- Adaptable Repayment Schemes: They provide flexible repayment plans designed to accommodate different financial situations.

- Inclusive Credit Considerations: Green Dollar Loans welcomes applications from clients with diverse credit histories, making it a practical option for those with less-than-perfect credit.

- Transparent Conditions: They pride themselves on transparency, clearly outlining terms and fees upfront.

- Robust Privacy and Security Measures: The platform uses advanced security technology to ensure the protection of personal and financial information.

Steps to Secure a Payday Loan from Online Lenders

Securing a payday loan from any lender requires careful consideration and a systematic approach:

1. Evaluate Your Financial Health

Before applying, assess your financial situation:

- Credit Score: Understanding your credit score can provide insight into your financial options.

- Budget Planning: Ensure you can manage the loan repayment terms within your budget to avoid further financial strain.

2. Choose the Right Lender

Research is crucial in selecting a suitable lender:

- Compare Options: Investigate various lenders to compare terms, interest rates, and user feedback.

- Verify Legitimacy: Confirm the lender’s credibility through reviews and regulatory compliance to avoid scams.

3. Prepare Your Application

Gather necessary information and documents:

- Personal and Financial Details: This typically includes ID verification, contact information, employment status, and financial records.

- Bank Details: For direct deposit of the loan amount.

4. Application Submission

Follow these steps to complete your application:

- Accuracy Check: Ensure all provided information is correct.

- Understand the Terms: Thoroughly review the loan agreement’s terms and conditions.

- Submit: Once satisfied, submit your application.

5. Await Approval

Approval can be swift, with many lenders responding within the same day:

- Response Time: Many lenders often provide a decision shortly after application submission.

- Funds Disbursement: Upon approval, the funds are usually available within one business day.

Customer Feedback of Green Dollar Loans

When selecting a financial solution like a payday loan, it is essential to assess the credibility and client experiences with providers. This examination will focus on whether Green Dollar Loans is legit and what the customer feedback indicates about their services.

Green Dollar Loans Reviews

Customer reviews of this platform often highlight several key aspects:

- Ease of Application: Clients frequently appreciate the’ straightforward application process, emphasizing its user-friendliness and efficiency.

- Quick Service: A recurring theme in Green Dollar Loans reviews is the rapid processing and disbursement of funds, which is crucial for borrowers in urgent financial situations.

- Responsive Customer Support: Positive reviews often note this service provides helpful and prompt customer service, which significantly enhances the borrowing experience.

Always remember that all potential borrowers should be aware of the higher interest rates associated with payday loans, which are also noted in Green Dollar Loans reviews. Borrowers need to understand these rates thoroughly to ensure they can manage repayments without financial strain.

Is Green Dollar Loans Legit?

In investigating the legitimacy of Green Dollar Loans, the following points are crucial:

- Transparency: This platform is praised for its transparency, clearly stating all loan terms, conditions, and fees upfront. This transparency helps answer the question, “Is Green Dollar Loans legit?” by affirming their commitment to honest disclosure.

- Secure Practices: They employ rigorous security measures to protect personal and financial information, which is vital for maintaining trust and safety in financial transactions.

- Regulatory Compliance: This service ensures compliance with federal regulations making it a legitimate platform.

Practical Tips for Evaluating Lenders:

- Detailed Review: Always read through all documentation provided by lenders. Understanding the fine print can prevent misunderstandings related to fees and repayment terms.

- Inquire About Fees: Explicitly ask about or search for any potential hidden fees associated with your loan.

- Consultation: If in doubt, consider consulting a financial advisor to help assess whether a loan fits your financial situation or not.

Our Green Dollars Loan Reviews Are

With a straightforward application process and rapid funding, Green Dollar Loans stands out as a dependable provider of payday loans. These services are even available for those with less-than-perfect credit histories. All terms and fees are transparently communicated to help borrowers make informed decisions.

Green Dollar Loans is a legitimate lender that efficiently caters to urgent financial needs while prioritizing robust security measures for personal data protection. However, borrowers should be fully aware of the high interest rates associated with payday loans. This understanding will help avoid potential debt traps and ensure financial stability.

Ultimately, Green Dollar Loans provides a valuable service for those in immediate need. Remember, every financial commitment should be approached with careful consideration and a clear understanding of all obligations and consequences.

Frequently Asked Questions

Is Green Dollar legit?

Yes, Green Dollar Loans is a legitimate payday loan provider. They are known for their transparency in terms and conditions, adherence to regulatory standards, and robust security measures to protect personal and financial information.

How does Green Dollar work?

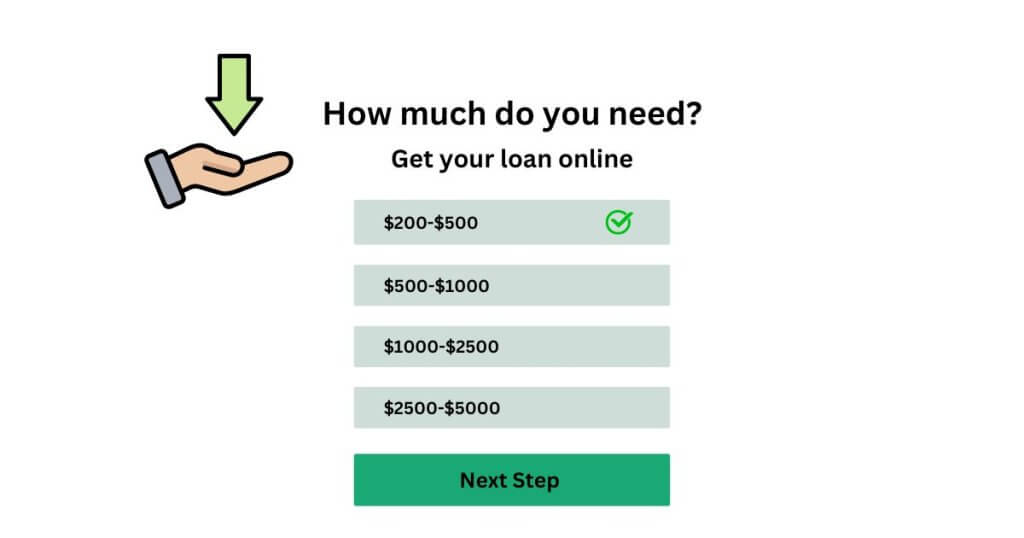

Green Dollar Loans operates as an online payday loan service. Applicants can fill out a quick application form on their website, providing personal and financial details. Once approved, typically within a day, the loan amount is directly deposited into the borrower’s bank account. Repayment terms and schedules are clearly outlined during the application process.

What is a dollar loan?

A dollar loan generally refers to a payday loan, which is a short-term borrowing option in which you can borrow a small amount of money, usually between $100 and $1,000, to be repaid with your next paycheck. These loans are intended for urgent financial needs and often come with high interest rates.

How to get an urgent loan?

To get an urgent loan, start by selecting a reputable lender and completing their online application. You’ll need to provide identification, proof of income, and bank details. Most urgent or payday loans are processed quickly, with funds possibly deposited into your account within 24 hours after approval. Always review the terms and interest rates to ensure you can meet the repayment obligations.