Did you know that shoppers saved over $1 billion last year on tax-free days across the U.S.? Here’s how you can make the most of these money-saving opportunities.

Every year, states across the U.S. offer tax-free days, giving many parents and students the perfect opportunity to snag those must-have items without the added burden of sales tax.

Whether you’re a parent gearing up for back-to-school shopping, a tech enthusiast looking to upgrade your gadgets, or simply someone who loves a good deal, tax-free days can land you big savings.

First, let’s understand what and when are these big saving days and how they are operated.

What Are Tax-Free Days?

Tax-free days, AKA sales tax holidays, are special periods during which the purchase of specific items comes without paying state sales tax. These holidays are typically timed to coincide with the back-to-school season, mainly at the end of July or early August.

Origins and Evolution

The concept of tax-free days was first introduced in the late 1990s as a way to stimulate consumer spending and provide financial relief to families during the back-to-school shopping season.

New York was the first state to implement a sales tax holiday in 1997. The primary goal was to boost retail sales and help families save on essential items, especially during the economically critical back-to-school period. New York’s initial success prompted other states to adopt similar measures.

Over the years, the scope and timing of sales tax holidays have evolved. While the initial focus was on back-to-school items such as clothing and school supplies, many states have expanded their tax-free periods to include a wider range of products.

Additionally, some states have experimented with the timing and duration of their tax-free days. While most states hold these holidays in the summer, some have added additional periods at other times of the year, such as during the holiday shopping season or in preparation for weather emergencies.

Benefits of Tax-Free Days

So why should you mark your calendar for these events? First and foremost, the savings can be substantial. Imagine buying a new laptop for school or a complete set of back-to-school supplies without the added cost of sales tax.

For many families, especially those with multiple children, back-to-school shopping can be a significant expense. Sales tax holidays can provide some relief from financial stress, making it easier to afford all the necessary items for the school year for your kids. Also, if you’re planning to make significant purchases like a new computer or electronics, the savings from not having to pay sales tax can really add up.

Retailers also benefit from these tax-free weekend sales. The increased foot traffic and sales volume during tax-free weekends can be a significant boost, helping businesses move inventory and attract new customers. Many retailers will also offer additional sales and discounts during these periods to further sweeten the savings for consumers.

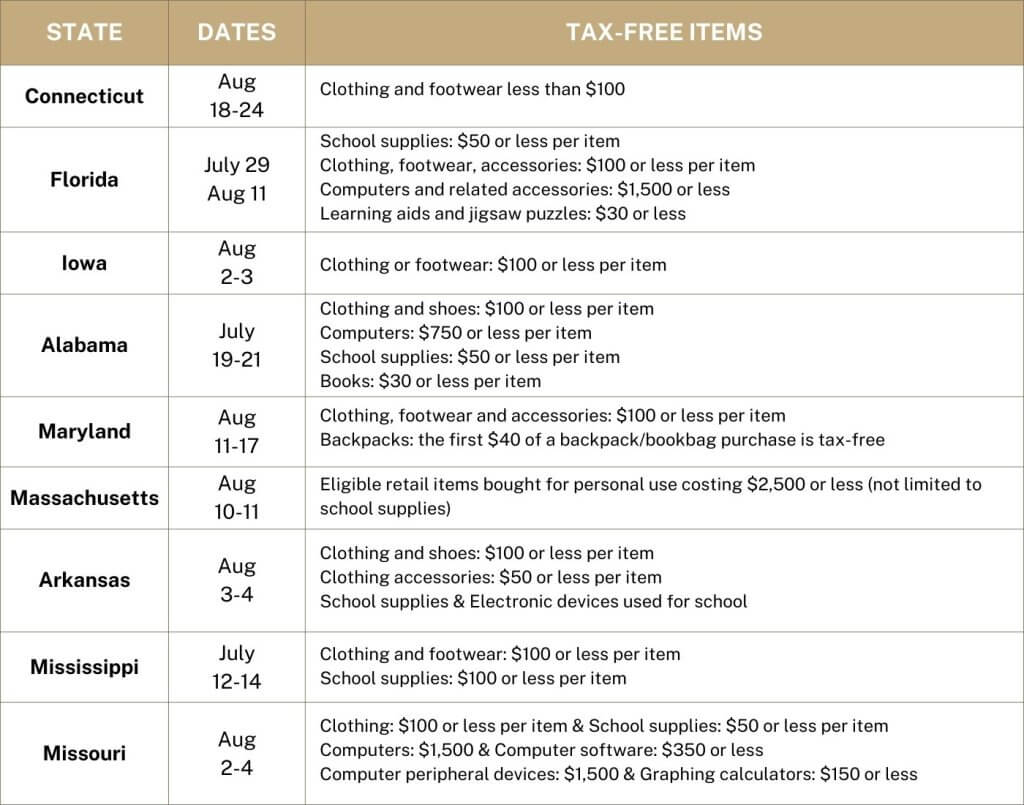

***State-wise dates for 2024 sales tax holiday

The Numbers: Savings and Participation

The popularity and impact of sales tax holidays have grown significantly since their inception. Here are some numbers from the past two years that highlight the scale of these events:

2023:

- Total Savings: Shoppers across the U.S. saved approximately $1.2 billion during these days.

- Participation Rates: An estimated 85% of eligible shoppers took advantage of tax-free days in their states.

- Retail Sales Increase: Retailers reported an average increase of 28% in sales volume during sales tax holidays compared to regular weekends.

2022:

- Total Savings: Shoppers saved around $1.1 billion during this season.

- Participation Rates: Approximately 82% of eligible shoppers participated.

- Retail Sales Increase: Retailers experienced an average sales volume increase of 25% during tax-free weekends.

These figures underline the significant financial benefits that tax-free days offer to both consumers and retailers. The increased participation rates and sales volume highlight the importance of these holidays in the retail calendar.

Tips for Big Savings on Tax-Free Days

Planning ahead is crucial to make the most of tax-free days. Start by making a list of the items you need and check your state’s guidelines to ensure they are eligible for the tax exemption. Look for sales and promotions that coincide with sales tax holidays to maximize your savings even further. Many retailers will offer additional discounts during these periods, so be sure to compare prices and shop around.

If you’re shopping online, verify that the retailer is participating in the sales tax holiday. Not all online stores may offer the same tax-free benefits, so it’s essential to do your research. Some states may have specific rules for online purchases, so make sure you understand the requirements before you buy.

Consider shopping early to avoid the crowds and ensure you get the items you need. Major malls and outlets get busy during this season, with many people taking advantage of the savings. By shopping early, you can beat the rush and have a more pleasant shopping experience.

Tax-Free Days: Recent Trends and Updates

With the rise of e-commerce, some states are updating their rules to include online purchases in sales tax holidays. As we all know, it can be comfortable not having to fight in the crowd. With online purchases, more people are taking advantage of the savings.

Additionally, many states are extending the duration or expanding the scope of their tax-free periods in response to economic conditions or natural disasters. Stay informed about the latest updates in your state to take full advantage of these opportunities.

For example, Ohio has expanded its tax-free period to 10 days, providing more time for consumers to shop and save. This extended period also includes a broader range of items, making it one of the most inclusive tax-free holidays in the country.

Conclusion

Tax-free days are a fantastic opportunity to save money on essential purchases. Whether you’re shopping for back-to-school supplies, upgrading your tech gear, or preparing for an emergency, sales tax holidays provide significant savings opportunities.

Make sure to check your state’s guidelines, plan your shopping list, and take advantage of these money-saving events.

So, get ready, set your reminders, and happy shopping! Don’t miss out on the chance to save big during these tax-free holidays.