While earthworms are often hailed as a farmer’s best friend, farmers should also be familiar with other allies. One such ally is Crop Insurance, a crucial tool in farming that can help in times of severe need.

Think of it as a financial safety net that helps farmers bounce back when things go wrong.

What You’ll Learn

In this blog, we’ll explore:

- The basics of crop insurance and its significance.

- How crop insurance premiums and subsidies function.

- The workings of different types of crop insurance, like Revenue Protection and Yield Protection.

- Key statistics and trends in the crop insurance market.

What is Crop Insurance?

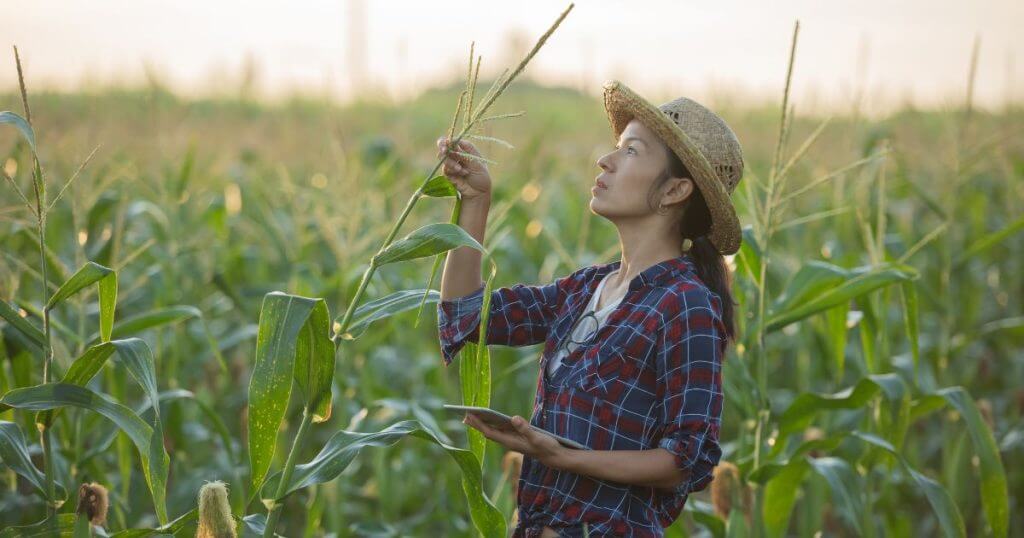

Crop insurance, a crop risk service, is a specialized type of insurance for farmers. Farmers spend countless hours tending to their fields, nurturing crops, and hoping for a bountiful harvest.

But what if an unexpected storm, a sudden drought, or a pest infestation ruins your efforts? It’s designed to protect against financial losses due to natural disasters, pests, diseases, and other unforeseen events.

Types of Crop Insurance (Agricultural Insurance)

There are several types of agriculture insurance companies that provide different crop risk services like the insurance types mentioned below:

- Multiple Peril Crop Insurance (MPCI): This comprehensive coverage addresses multiple threats and covers a wide range of risks, including weather events like drought and flood and pest infestations.

- Crop-Hail Insurance: Specifically designed to cover damage from hail. It’s unique in that it can be purchased at any time during the growing season.

- Revenue Protection (RP): Protects farmers from the dual risks of low yields and low market prices, ensuring they have a guaranteed level of income.

- Yield Protection (YP): Focuses solely on protecting against yield losses due to natural causes, not price changes.

Crop insurance is crucial for farmers and the wider agricultural industry as it offers essential financial security against unforeseen circumstances.

It guarantees that farmers are able to bounce back from losses and continue their operations and livelihoods even when faced with unexpected challenges. This financial security encourages farmers to invest in better seeds, advanced technology, and improved farming practices, leading to higher productivity and sustainability.

Crop insurance offers farmers the protection and confidence they need to continue producing food despite the uncertainties they face. Additionally, by encouraging steady farm incomes, crop insurance helps ensure a constant food supply, which is crucial for economic stability and food security.

Another superstar among these is Index-based insurance, an innovative crop risk services provider. Insurers use predefined indices on rainfall levels and temperature changes, which can directly affect crop yields, to determine a claim cap and individual losses incurred by farmers to settle claims.

How do crop insurance premiums and subsidies function?

Crop insurance premiums are the payments that farmers make to secure insurance coverage for their crops. These premiums are influenced by various risk factors.

- Type of Coverage: Different types of agriculture insurance policies, such as Revenue Protection (RP) and Yield Protection (YP), come with different premium rates.

- Coverage Level: Farmers can choose different coverage levels (e.g., 50%, 65%, 75%, 85%), with higher coverage levels providing more protection but also resulting in higher premiums.

- Crop Type: Premiums vary based on the type of crop being insured, with some crops carrying higher risks and, therefore, higher premiums.

- Location: The geographic location of the farm affects the premium, as areas with higher historical risk (e.g., drought-prone regions) will have higher premiums.

- Historical Yield: The farmer’s Actual Production History (APH), which is the average yield over several years, influences the premium. Higher yields often mean lower premiums because they indicate lower risk.

- Market Prices: For revenue-based policies, the projected market prices of the crop also impact the premium.

Premium Calculation

Premiums are generally calculated using the formula:

- Premium = Liability * Premium Rate

Note:

* Liability: Calculated based on historical yield, coverage level, and projected price.

*Premium Rate: Set by the Risk Management Agency (RMA) and varies by crop, location, and coverage level.

How Subsidies Work

- Subsidy Structure: The federal government subsidizes a significant portion of the crop insurance premiums to make them affordable for farmers. The subsidy percentage depends on the type and level of coverage.

- Premium Subsidies: For joint policies like RP and YP, the subsidy rates range from 38% to 80%. For example, at a 50% coverage level, the subsidy might be 80%, so the farmer pays only 20% of the premium. At a 75% coverage level, the subsidy might be 55%, meaning the farmer pays 45%.

- Administrative and Operating Subsidies: The government also provides subsidies to cover the administrative and operating costs for private insurance companies that sell and service crop insurance policies. This ensures that these companies can operate efficiently and provide necessary services to farmers.

Crop insurance premiums and subsidies work together to make agriculture insurance affordable and accessible for farmers. Premiums are calculated based on various risk factors, while subsidies significantly reduce the cost to farmers.

This system ensures that farmers have the financial protection they need to manage the uncertainties of agriculture, encouraging investment and stability in the sector.

Yield Protection

Yield Protection (YP) is a type of crop insurance that protects farmers against losses in crop yield. This means if a farmer’s actual crop production falls below a certain level due to natural events like drought, flood, or pests, the insurance helps cover the financial loss.

Here’s how it works:

- Historical Yield (APH): The farmer’s average yield over the past several years is calculated.

- Coverage Level: The farmer chooses a percentage of this average yield to insure, usually between 50% and 85%.

- Guaranteed Yield: This is the insured yield level. If the actual yield is less than this guaranteed yield, the farmer receives a payout.

For example, if a farmer’s historical yield is 100 bushels per acre and they choose to insure 75%, their guaranteed yield is 75 bushels per acre. If they only harvest 50 bushels due to bad weather, the insurance compensates for the loss of 25 bushels.

Revenue Protection

Revenue Protection (RP) offers a broader safety net by covering both yield losses and price drops. It ensures that farmers receive a minimum amount of revenue, even if market prices fall or their crop yield is low.

Here’s how it works:

- Historical Yield (APH) and Coverage Level: Similar to YP, the farmer’s historical yield and chosen coverage level determine the insured yield.

- Projected Price: The expected market price of the crop at planting time.

- Revenue Guarantee: Calculated as the guaranteed yield multiplied by the projected price.

For example, if a farmer’s historical yield is 100 bushels per acre, they insure 75%, and the projected price is $4 per bushel, the revenue guarantee is $300 per acre (75 bushels * $4). If the actual revenue (actual yield * harvest price) falls below this amount, the insurance covers the difference.

Yield Protection and Revenue Protection provide financial security for farmers by safeguarding against low crop yields and covering price risks. These insurance types help farmers manage agricultural uncertainties and protect them against market fluctuations.

Crop Insurance: CAGR, Stats, and Scope

Overview of the Crop Insurance Market in the U.S.

Crop insurances are crop risk services in the agricultural sector in the United States which is managed by the USDA risk management agency. They provide farmers with financial protection against various risks. The market has grown significantly over the years, ensuring stability and promoting investment in agriculture.

Key Statistics

- Coverage: In 2023, over 380 million acres of farmland were insured, compared to 360 million acres in 2022. This widespread coverage highlights the program’s importance to U.S. farmers.

- Policies: More than 1.1 million crop insurance policies were issued in 2023, covering a variety of crops, including major commodities like corn, soybeans, and wheat.

- Premiums and Subsidies: Total premiums in 2023 amounted to approximately $12 billion, up from $11.5 billion in 2022. The federal government subsidized around 60% of these premiums, making crop insurance affordable for farmers.

- Indemnities: Indemnities (payments to farmers for insured losses) totaled around $8 billion in 2023. These payments help farmers recover from adverse events and maintain their operations.

- Government Expenditure: The federal government’s total expenditure on agriculture insurance, including premium subsidies and administrative costs, was about $10 billion in 2023.

Compound Annual Growth Rate (CAGR) Analysis

- Insured Acres: From 2022 to 2023, insured acres increased from 360 million to 380 million, with a CAGR of approximately 5.56%.

- Total Premiums: Total premiums grew from $11.5 billion in 2022 to $12 billion in 2023, with a CAGR of about 4.35%.

- Government Subsidies: Government subsidies increased from $7 billion in 2022 to $7.2 billion in 2023, with a CAGR of around 2.86%.

The U.S. agriculture insurance market is a critical component of the agricultural sector, providing essential protection and promoting stability and growth. With ongoing innovations and an expanding scope, crop insurance continues to adapt to farmers’ needs, ensuring the resilience and sustainability of U.S. agriculture.

The Fine Line between the Insured and Non-Insured Crop

Imagine two farmers, John and Sarah, both growing the same crops. John has invested in crop insurance, while Sarah has not. When a sudden storm hits, both farms suffer significant damage.

John, with his crops insured, files a claim and receives financial support to recover his losses. This allows him to replant and continue his farming operations without severe financial strain.

On the other hand, Sarah faces a challenging situation. Without insurance, she must bear the full brunt of the loss. She might struggle to find the funds to replant or cover her expenses, potentially jeopardizing her farm’s future.

Crop insurance creates a fine line between these scenarios. It provides a safety net that can make the difference between bouncing back quickly or facing financial hardship. By understanding and opting for crop insurance, farmers like John ensure their hard work is protected, regardless of what nature throws their way.

Frequently Asked Questions

What is the trend in crop insurance?

The trend in crop insurance is toward greater integration of technology, such as precision agriculture and data analytics, to improve risk assessment and efficiency. There is also an increasing focus on sustainability, with policies incentivizing climate-resilient farming practices.

What percentage of farmers have crop insurance?

Approximately 90% of the insurable farmland in the U.S. is covered by crop insurance, indicating that a significant majority of farmers recognize its importance and participate in the program.

Is crop insurance a good idea?

Yes, crop insurance is generally a good idea as it provides crucial financial protection against unpredictable risks like adverse weather, pests, and diseases. This security helps farmers maintain their operations and invest in better practices, contributing to overall agricultural stability.

Who are the top crop insurance companies in the U.S.?

Some of the top crop insurance companies in the U.S. include:

- Crop Risk Services(ProAg (Producers Ag Insurance Group)

- Great American Crop Insurance

- Rain and Hail LLC

- Rural Community Insurance Services (RCIS)

- Farmers Mutual Hail Insurance Company of Iowa (FMH)

These companies, in collaboration with the USDA Risk Management Agency, provide extensive coverage options and support to farmers nationwide.

What are the negatives of crop insurance?

Crop insurance, despite its benefits, has some drawbacks. High premiums and complex policies can be burdensome for farmers, particularly smaller ones. There’s also the issue of “moral hazard,” where insured farmers might take greater risks, knowing they are covered. Additionally, the cost of government subsidies, managed by the USDA Risk Management Agency, is significant and can strain public resources.